California’s New $30k/$60k Minimums: Does the 2025 Insurance Hike Mean Higher Settlements for You?

The End of the 15/30/5 Era

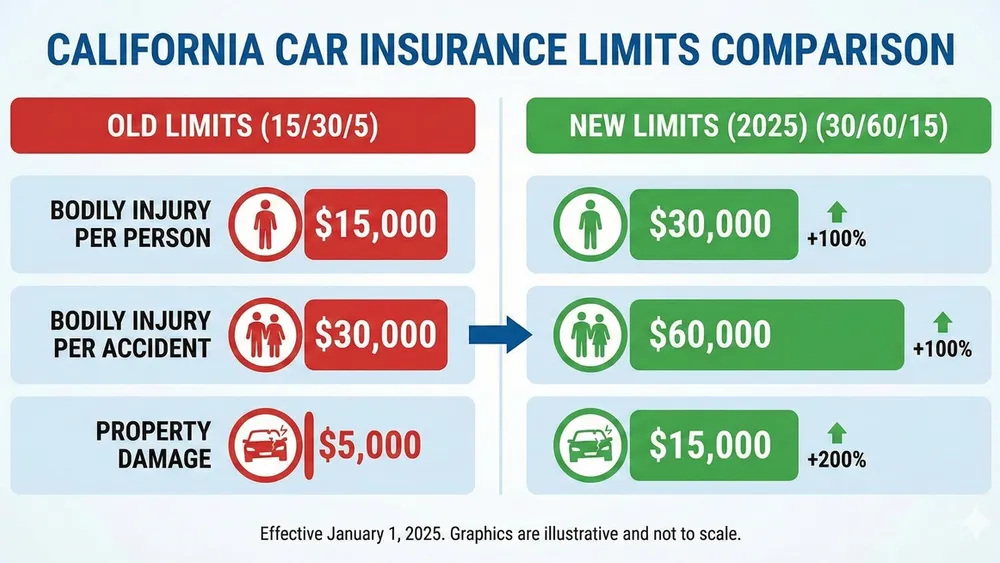

For over 50 years, California drivers operated under incredibly low financial responsibility limits: $15,000 for injury to one person, $30,000 per accident, and $5,000 for property damage. Starting January 1, 2025, Senate Bill 1107 has officially doubled these minimums to $30,000 per person and $60,000 per accident (with property damage rising to $15,000). This change was long overdue; with modern medical costs, the old $15,000 limit was often exhausted by a single emergency room visit. For accident victims, this immediately raises the "floor" of available compensation from a minimum-policy driver, ensuring that there is at least double the coverage available for medical bills and lost wages compared to previous years.

How Higher Limits Influence Settlement Offers

Affected by a Motor Vehicle Issue?

Our specialized tool can help you estimate the potential worth of your case based on current laws and precedents.

In the world of personal injury law, the "policy limit" often acts as a functional ceiling for settlement negotiations. If an at-fault driver has no personal assets, an attorney can typically only recover what the insurance policy covers. With the minimum jumping to $30,000/$60,000, the "starting pot" for negotiations has effectively doubled. This means that for moderate injury cases—such as whiplash or fractures requiring physical therapy—victims are far less likely to be "capped out" at an insufficient $15,000. Consequently, we expect to see the average settlement value for minimum-policy cases rise significantly in 2025, simply because the insurance carriers are now on the hook for a larger sum.

The "Underinsured" Reality Check

While the increase is good news, it introduces a new layer of complexity regarding Underinsured Motorist (UIM) coverage. If you are injured by a driver carrying the new minimums, but your damages exceed $30,000 (which is common in severe accidents involving surgery), you will still need to rely on your own UIM coverage to bridge the gap. Crucially, if you have not updated your own policy to exceed these new state minimums, your UIM coverage might not trigger. It is vital to ensure your own uninsured/underinsured motorist limits are well above the $30k/$60k threshold so that you remain protected against catastrophic injuries that surpass the state's new mandatory minimums.

Evaluating Your Case Value in the New Landscape

Determining the value of a case is never just about adding up medical bills; it is about finding the available funds to pay for them. The 2025 legislative changes mean that the "uncollectible" portion of many claims may shrink. However, insurance adjusters may fight harder to minimize payouts now that their exposure has doubled. They may scrutinize medical records more aggressively to argue that a claim is only worth $20,000 rather than the full $30,000 limit. Understanding these new dynamics is essential for anyone injured in a 2025 accident, as the strategy for demanding the policy limit will evolve to match these higher financial stakes.

Disclaimer: This blog post is for informational purposes only and does not constitute legal advice. For specific legal guidance regarding your situation, please consult with a qualified attorney.